🤝 All funds raised via NFT sales go directly back to our contributors each week. Thank you for supporting community-driven crypto analytics!

🕛 About the editor: Spencer Noon is an investor at Variant, an early-stage crypto VC fund. Founders should DM him to get in touch.

⭐ Click here to apply to the 🆕 Our Network Talent Agency

📥 Subscribe to the newsletter and get Our Network delivered straight to your inbox every week.

① Compound

📈 4 New Markets Added to Compound

👉 Community Discord 📌 Job Board 🔎 Dashboard

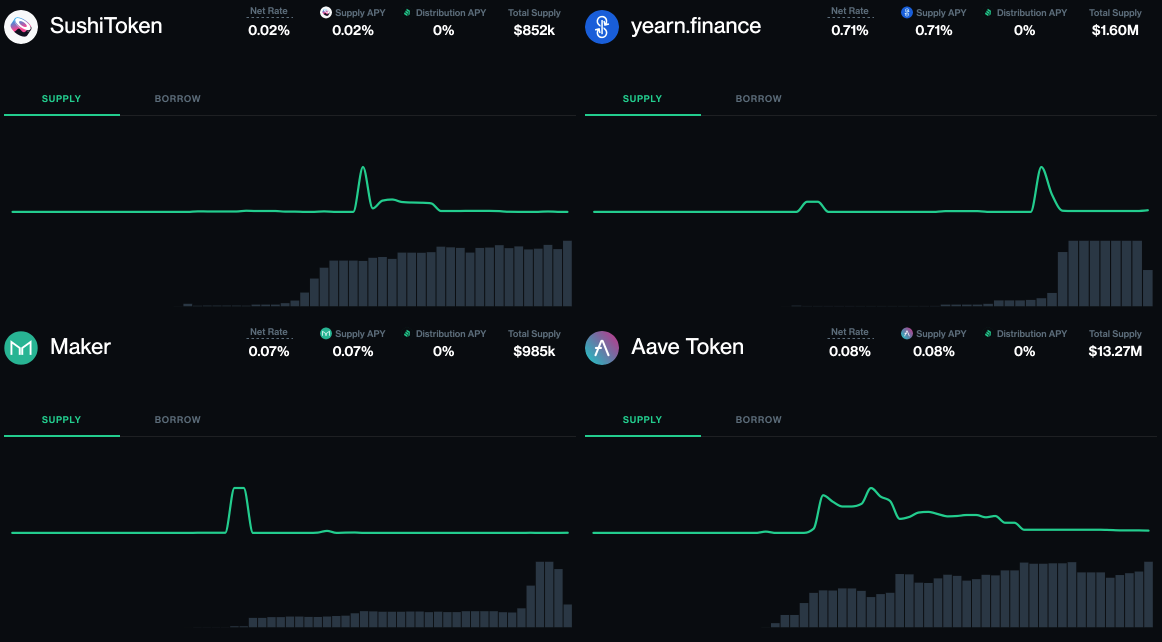

- The Compound protocol is a set of open-source interest rate markets for earning interest and borrowing assets. Since August 1st, the community voted to add 4 new assets: MKR, SUSHI, YFI, and AAVE. These markets added $16.7M of liquidity to the protocol, with larger volumes expected once the community enables COMP rewards and increases the collateral factor for each market. Besides added liquidity, new markets encourage new developers and communities to participate in the Compound ecosystem.

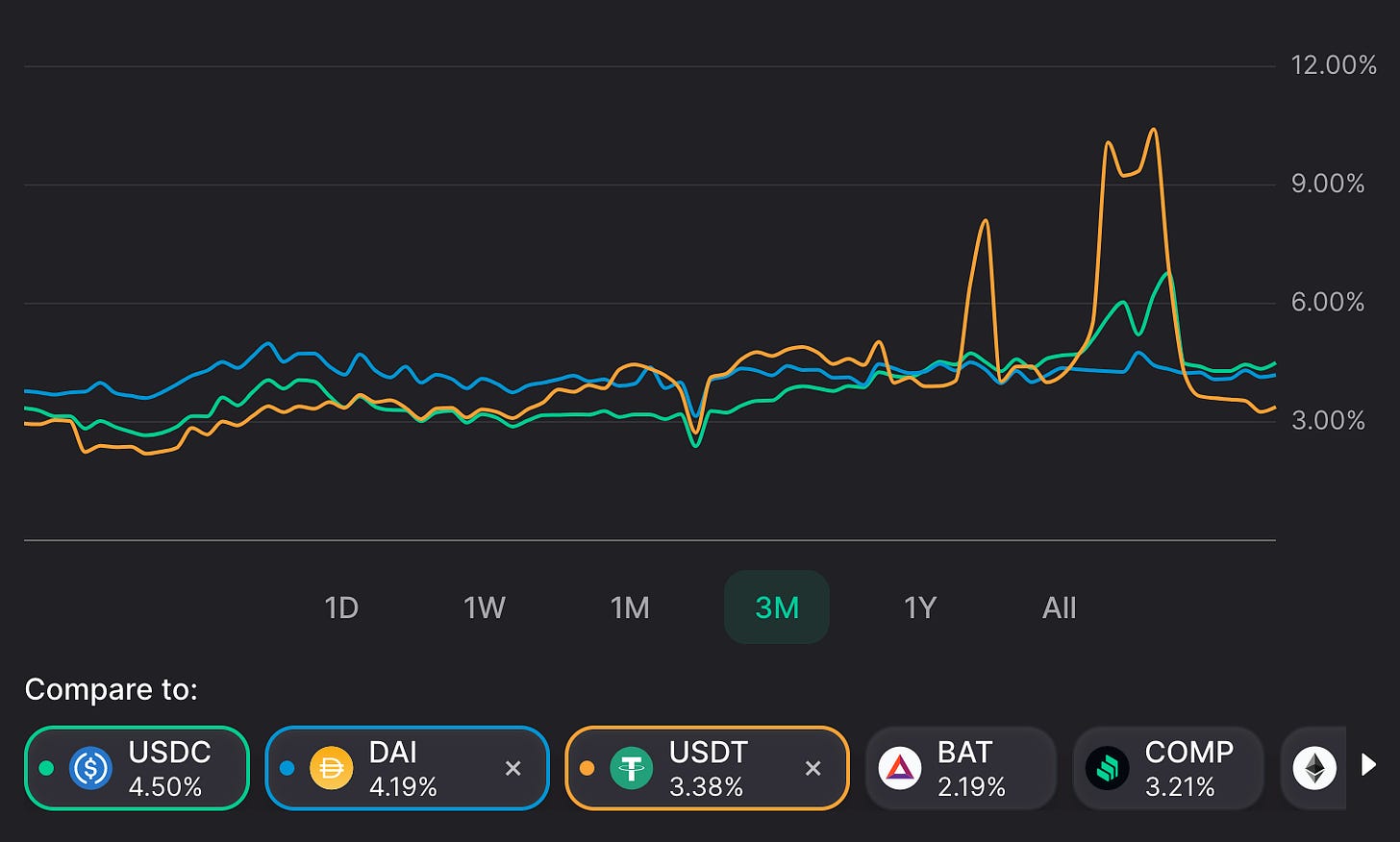

- The supply interest rates for the top 3 stablecoins on Compound (USDC, DAI, USDT) have grown steadily over the past 3 months, from an average of 3.36% APY on June 18th to 4.02% APY on September 15th. These rates can serve as a useful barometer to gauge the market demand for leverage and liquidity.

- The Compound protocol continues to have strong daily usage, with nearly 600 transactions, $371M of assets being supplied, and $167M of assets being borrowed in the past 24 hours.

② Liquity

👥 Kolten

📈 Liquity sees 118% growth in Troves since May

👉 Community Discord 📌 Job Board 🔎 Dashboard

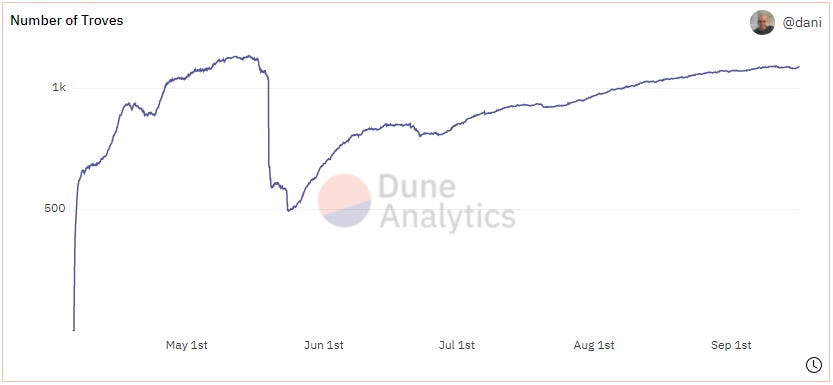

- The last time Liquity was featured in Our Network (May 21st), the protocol had just seen its first major set of liquidations due to the market crash on May 19th. Since then, we’ve seen a 118% increase in Troves — from 496 Troves to 1,086 Troves — signaling that there’s still growing demand for LUSD’s interest-free, high LTV borrowing. Remember: borrowers only pay a one time, upfront fee of ~0.5% to borrow LUSD against their ETH.

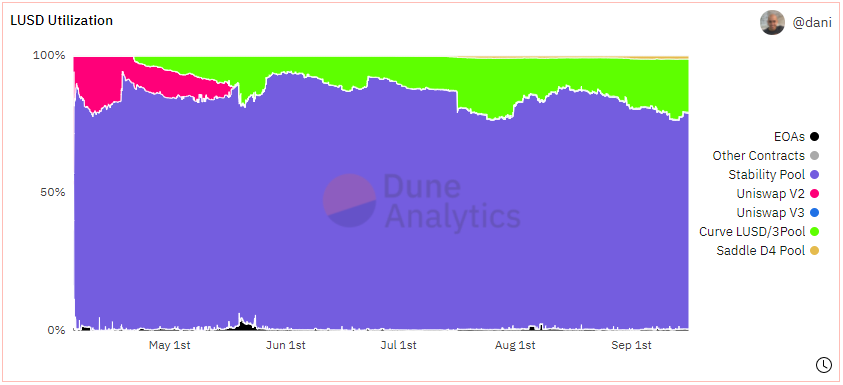

- Liquity's “Stability Pool'' has been LUSD's primary use case since launch. Users deposit LUSD and in return, they receive LQTY and purchase ETH at a discount when Troves are liquidated. Fortunately, as LUSD continues to mature, we're seeing Stability Pool dominance shrink to all-time-lows.

- I mentioned that the Stability Pool pays out LQTY, which can then be staked to earn Liquity's protocol revenue generated from fees. Liquity has distributed $4.3M in protocol revenue to LQTY stakers since May and $14.6M has been distributed since our launch in April of this year.

③ Aave

👥 Llama

📈 Aave Pulls In $16.7M of Net Income YTD Aug 21st

👉 Community Discord 🔎 Dashboard

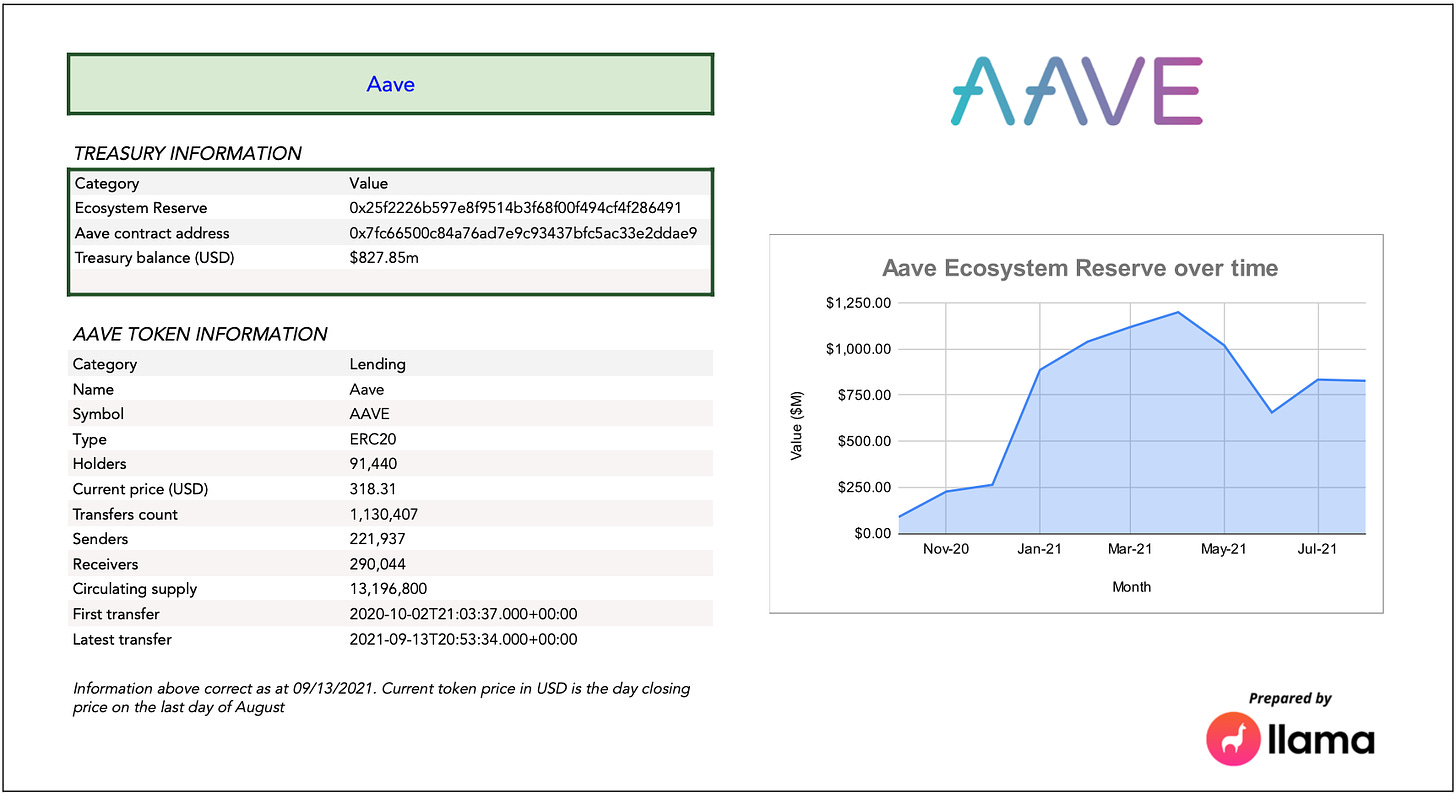

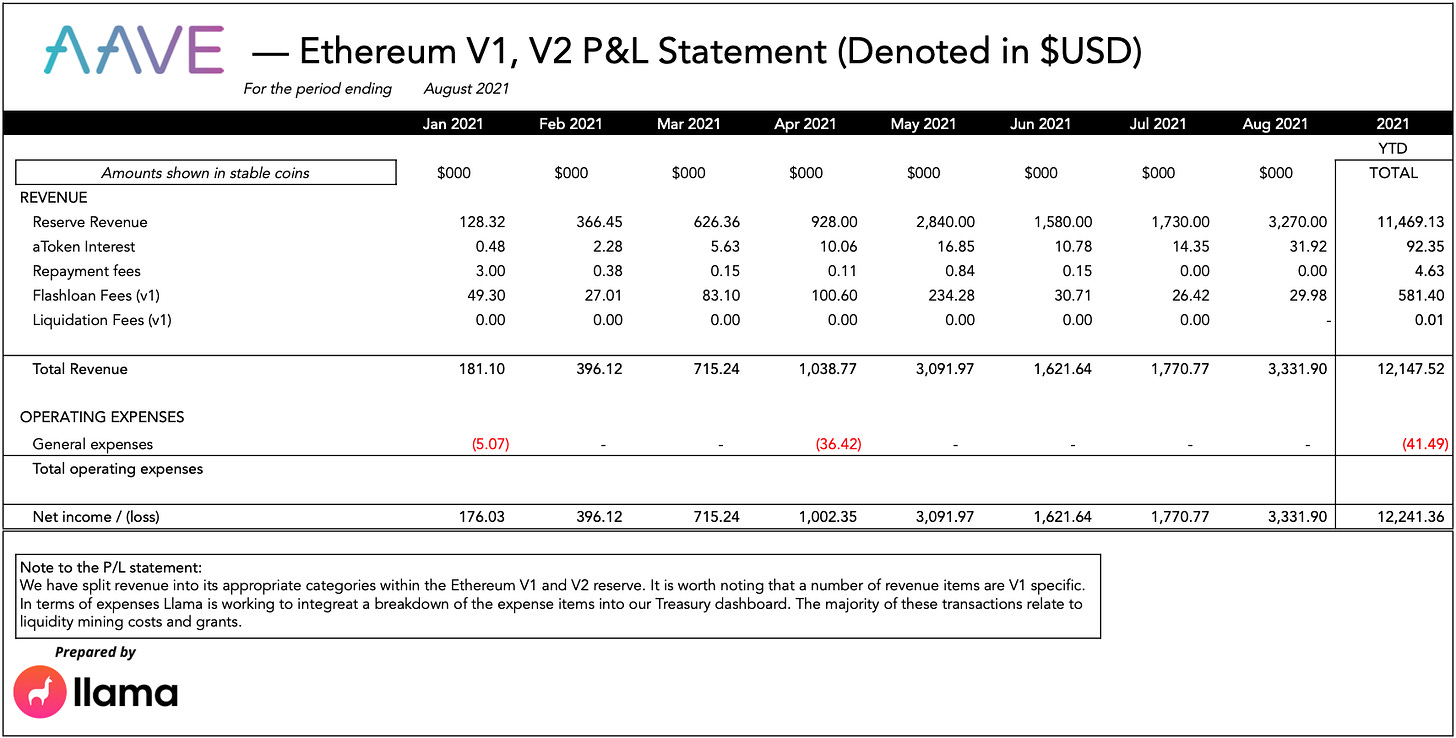

- Llama presented our first set of Financial statements for Aave. This comprises a Profit or loss statement for the various reserves within the network along with presenting an overview of treasury holdings and a holistic view of token transactions through our token flow statement. The accounts and Dune dashboard both aim to provide a high level overview of the DAO’s trading activity to date, something which is not currently widely available within DeFi.

- Llama has prepared two income statements, one specifically for the Ethereum ecosystem and the other for Polygon, both denoted in USD translated at the EOD token value. August shows a total net profit of: Ethereum V1, V2 - $12,241,360, and Polygon - $4,437,190.

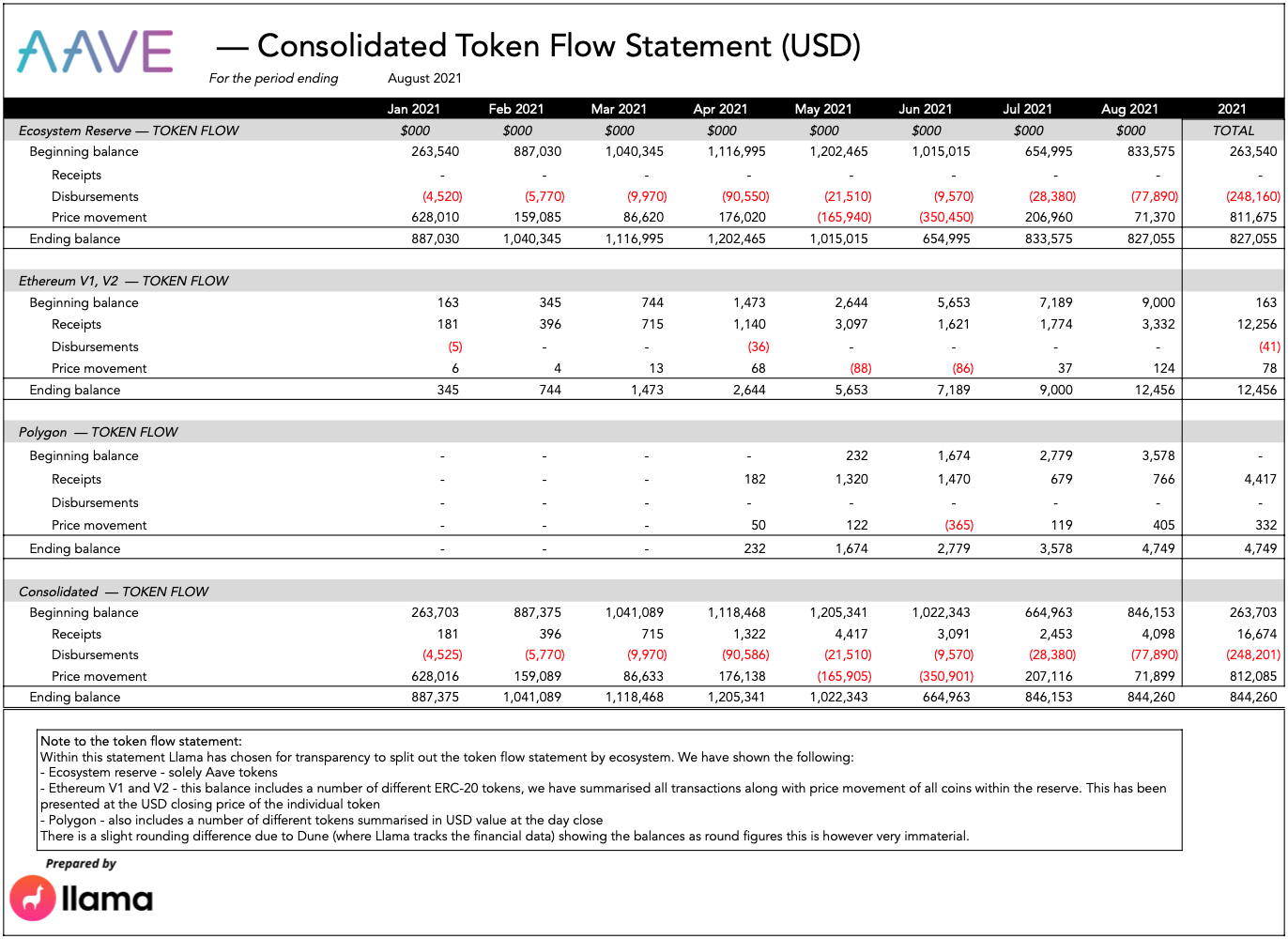

- Llama produced a holistic token flow statement. This has been prepared to show the flow of transactions on a monthly basis. The Aave and other ERC-20 tokens are translated using the USD price at month-end. We have also shown a consolidated view of the Ecosystem, Ethereum and Polygon Reserve.

④ C.R.E.A.M. Finance

👥 Max

📈 iceCream stakers earn ~$240k yvcrvIB since launch

👉 Community Newsletter 🔎 Dashboard

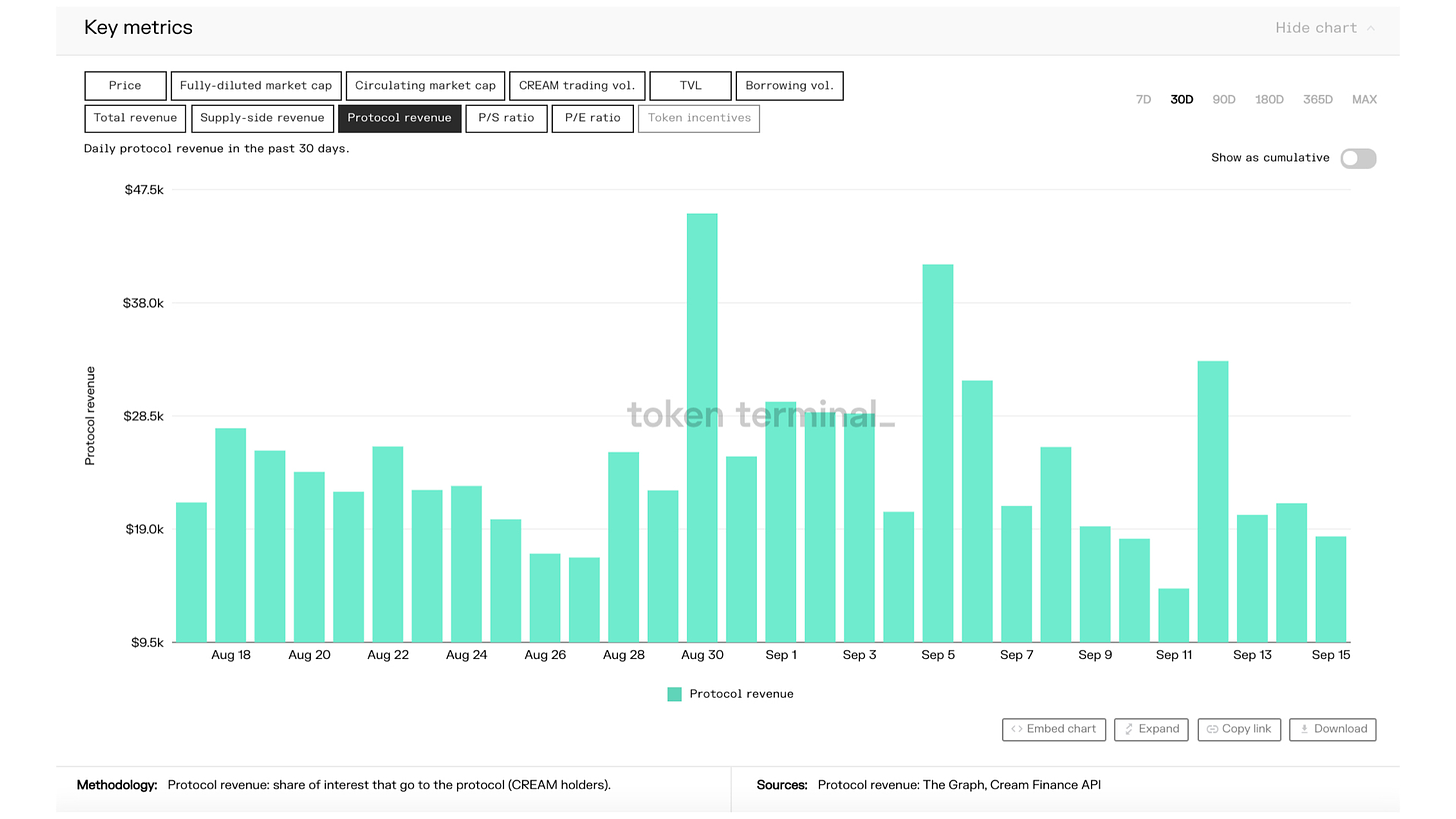

- C.R.E.A.M. Finance is a decentralized lending protocol. With the launch of C.R.E.A.M.'s new tokenomics, $iceCream, 50% of protocol revenues are distributed to iceCream holders. Since launch (4 weeks ago), iceCream stakers have earned 239,254 yvcrvIB, ~35% APR. According to Token Terminal, the C.R.E.A.M. protocol has collected $734.3k of protocol fees over the last 30-days. Annualizing this data, puts C.R.E.A.M. on a run-rate of $8.8M of protocol fees per year.

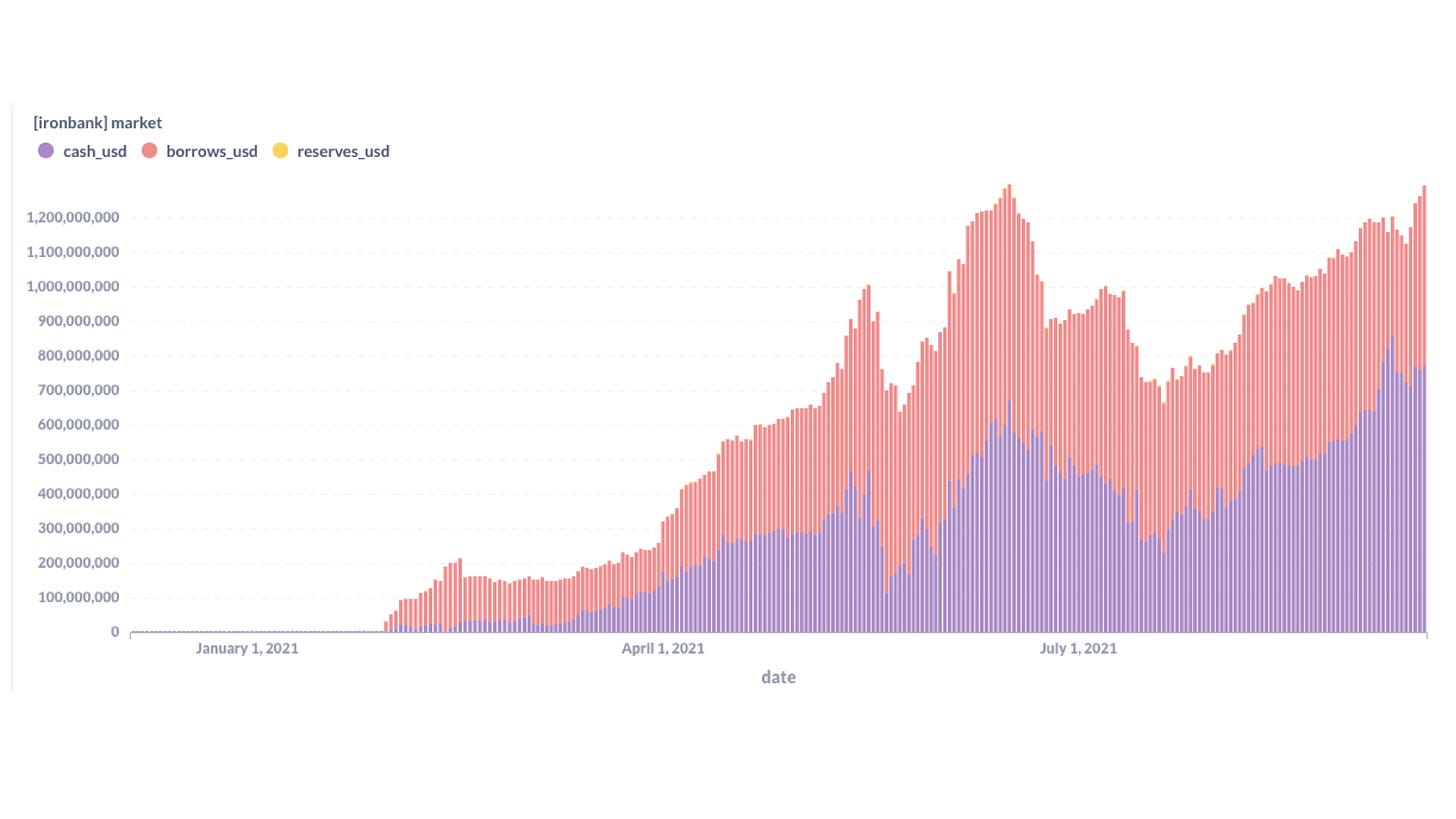

- Today, the Iron Bank broke an all-time-high in total supply, reaching $1.224B. The Iron Bank (IB) has 11 assets with at least $10M liquidity: wETH, USDT, USDC, DAI, ibEUR, ibKRW, ibGBP, ibCHF, wBTC, ibJPY, and ibAUD. Notably, the IB has a total supply of $176M of synthetic fiat in partnership with Fixed Forex.

- C.R.E.A.M. Finance’s ETH v1 market continues to show strong protocol market fit and attract new users. As of September 15th, C.R.E.A.M. Finance ETH v1 has 10,252 unique users. This represents a 51% increase in wallets interacting with ETH v1 markets, year-to-date.