All funds raised via NFT sales go directly back to our contributors each week. Thank you for supporting community-driven crypto analytics! 🤝

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund. DMs always open for entrepreneurs.

Subscribe: Click here to get the newsletter delivered straight to your inbox each week.

Our Community Is Hiring

DATA SCIENCE

- a16z is hiring a Data Science Engineer

- Coin Metrics is hiring a Data Scientist

- Dune Analytics is hiring a Crypto Data Specialist

- Edge & Node is hiring a Data Scientist

- 0x is hiring a Product Analytics Data Scientist

ENGINEERING

- Gearbox is hiring for multiple engineering roles

- Goldfinch is hiring a Senior Software Engineer

- Phantom is hiring a Senior iOS / React Native Engineer

- Sense is hiring a Senior Front End Engineer and a Senior SC Engineer

PRODUCT & DESIGN

- PoolTogether is hiring a Senior Designer

BIZ DEV & OPS

- Aleo is hiring a VP of Marketing

- Yield is hiring for a Go To Market Lead

EDITOR’S NOTE

- Don’t see your ideal role? Fill out my talent form and I’ll personally do my best to connect the dots with top projects in our community.

This week our contributor analysts cover L1s: Handshake, Bitcoin, Ethereum, and Terra.

① Handshake

👥 Zach Brown

📈 Handshake surpasses 1.6M names opened

👉 Join the Handshake community Discord

🔎 Check out the dashboard

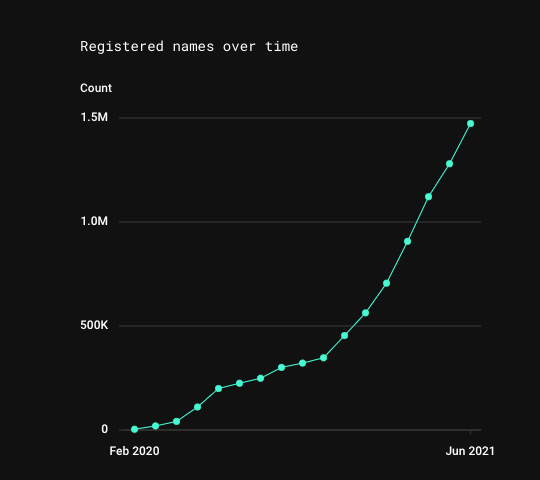

- Handshake is a decentralized naming protocol. 1.6M total names have been opened on Handshake in less than eighteen months. This is 1,000x more names than the 1.6K top level domains approved by ICANN in the traditional DNS root zone. This month of July marks one million names opened in the calendar year of 2021. Names opened are also up 25% since our last Our Network update eight weeks ago. (Source: Namebase)

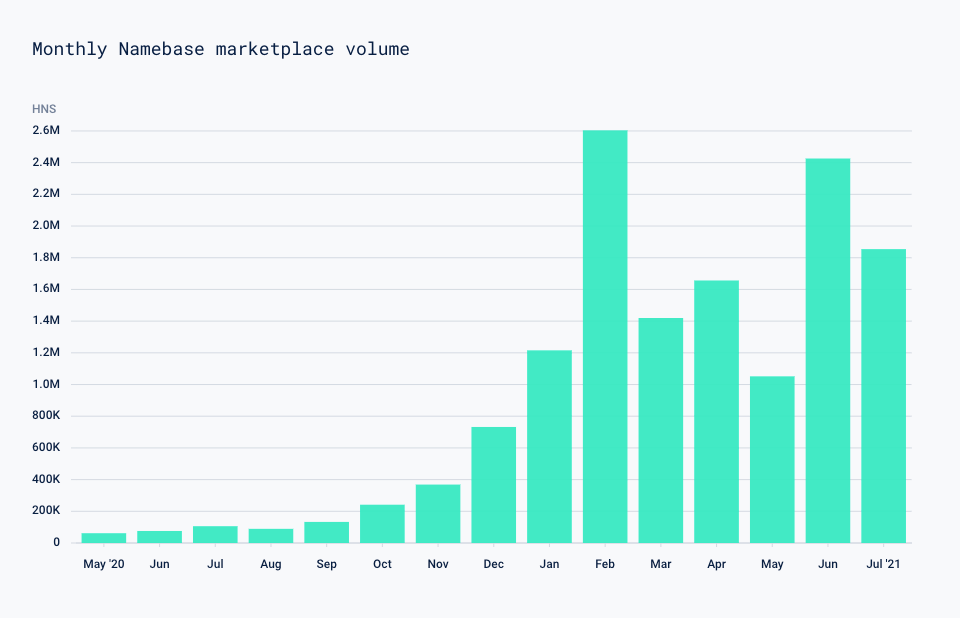

- Names are won through Vickrey auctions and then can be resold on secondary markets like Namebase or non-custodially via ShakeDex. The secondary market for Handshake names continues to grow, crossing 14M HNS in total resale volume. One third of resale volume has occurred within the last sixty days. (Source: Namebase)

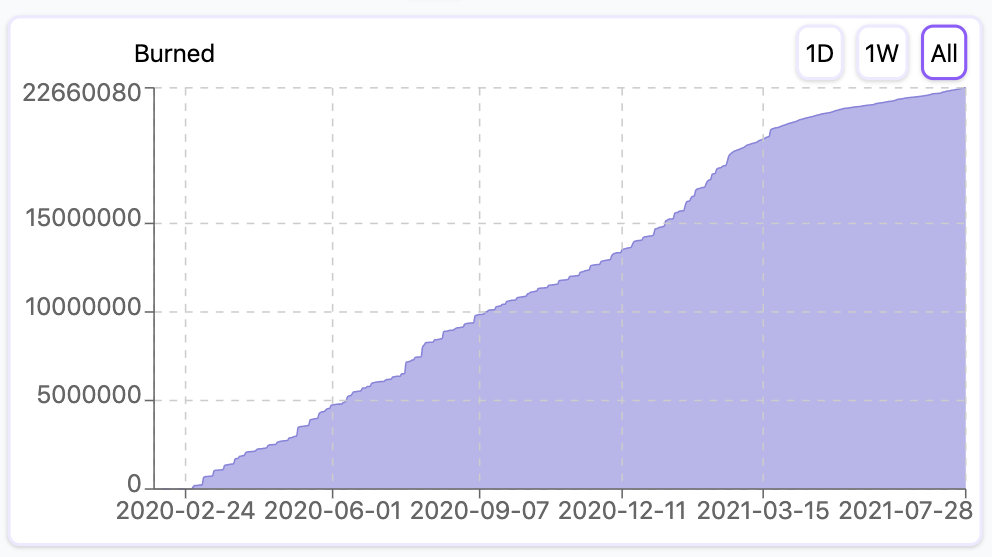

- Winning bid amounts for Handshake names are paid in $HNS and burned from supply, a deflationary pressure on the asset. Total HNS Burned is now 22.7M HNS, or 6% of circulating supply. Total HNS Burned is up 58% so far this year. (Source: Shakestats)

② Bitcoin

👥 Nate Maddrey

📈 Lightning Network Channels Up 14% Since July 1st

🔭 Explore Bitcoin Resources

📌 Become an Bitcoin contributor

🔎 Check out the dashboard

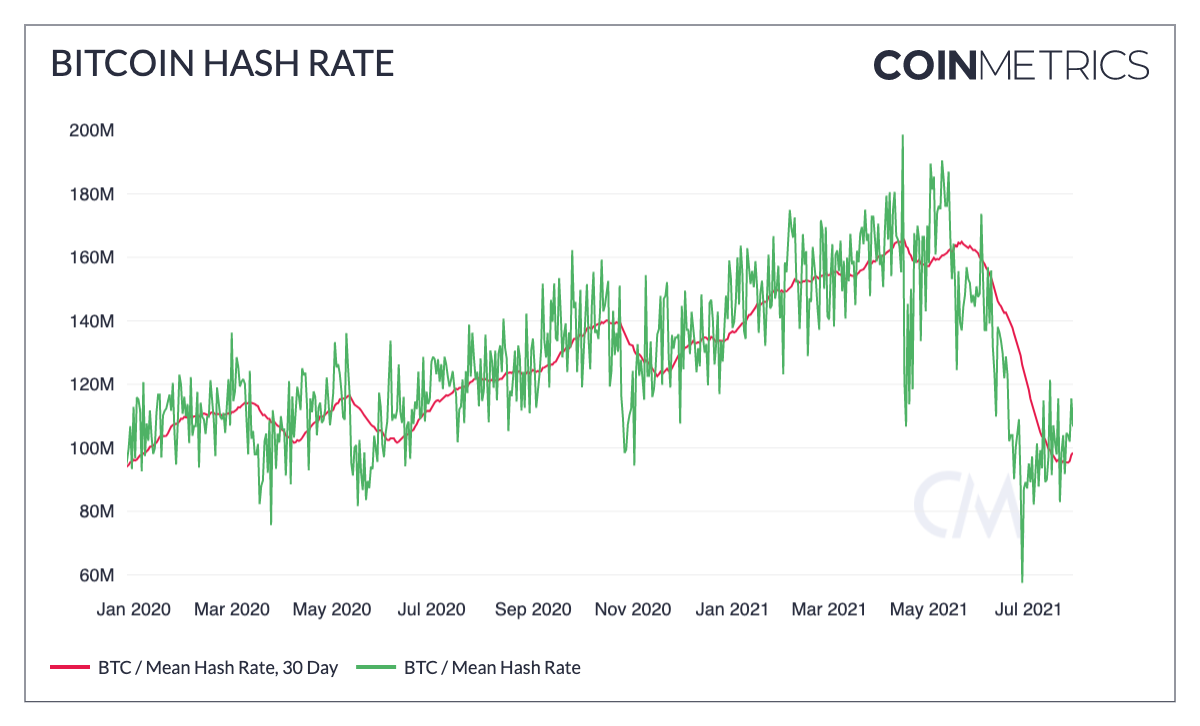

- Bitcoin’s hash rate is showing signs of recovery after dropping by over 50% following the May crypto crash. After China started a regulatory crackdown against mining operations, miners have been fleeing China and relocating to new areas. Following a few months of uncertainty, on-chain data suggests that some of those displaced mining operations are starting to come back online. The 30-day average hash rate began increasing in July for the first since the crash. (Source: Coin Metrics)

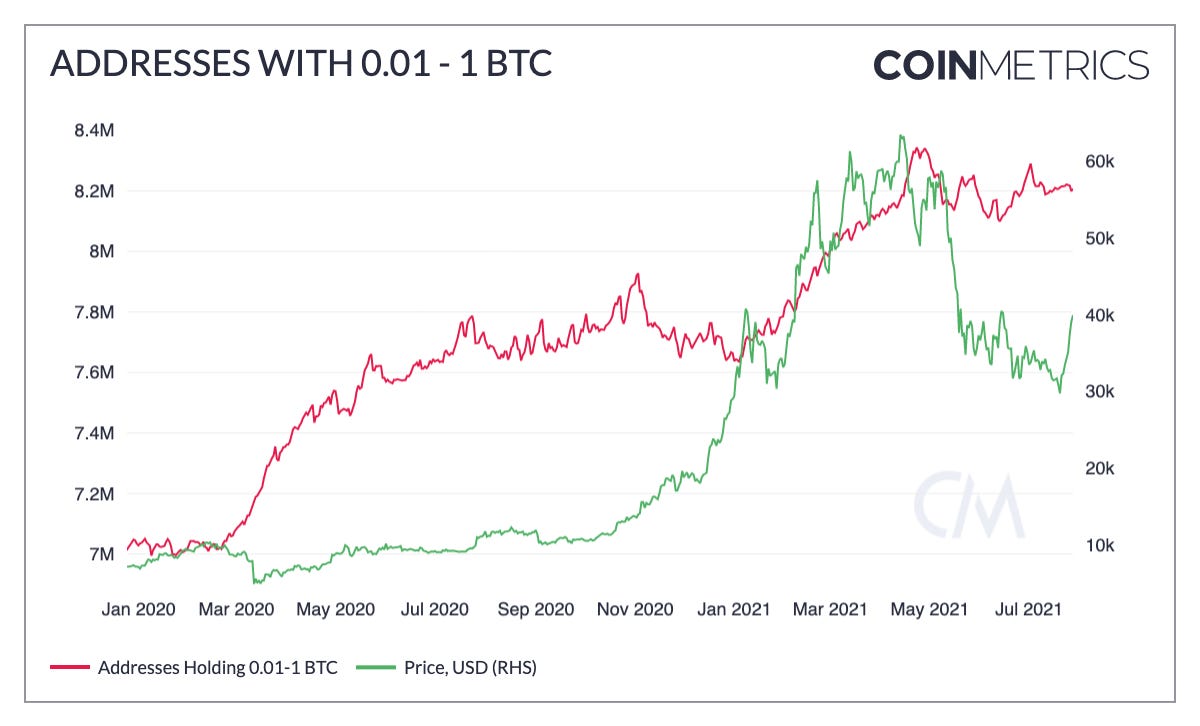

- The number of Bitcoin addresses holding between 0.01 and 1 BTC has held relatively steady despite the price crash. On May 11th, there were 8.17M addresses holding 0.01 - 1 BTC. As of July 27th, there are 8.20M addresses holding 0.01 - 1 BTC. (Source: Coin Metrics)

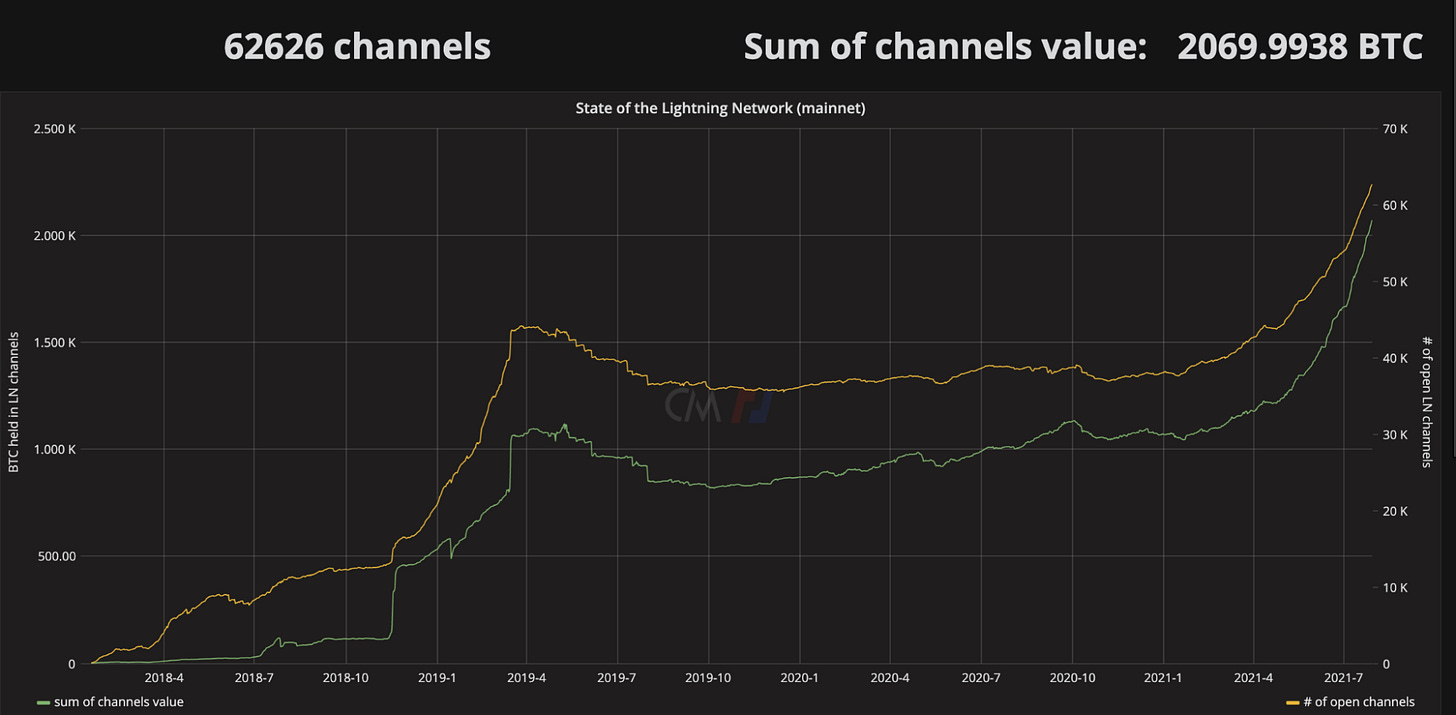

- The Lightning Network has shown strong growth in July. There are now over 62K open Lightning channels and over 2K BTC held on the network, up from 53.94K channels and 1.66K BTC on July 1st. (Source: txstats.info)

③ Ethereum

👥 Alex Gedevani

📈 26% of ETH supply in smart contracts

👉 Get involved with the Ethereum community

📌 Explore the Ethereum job board

🔎 Check out the dashboard

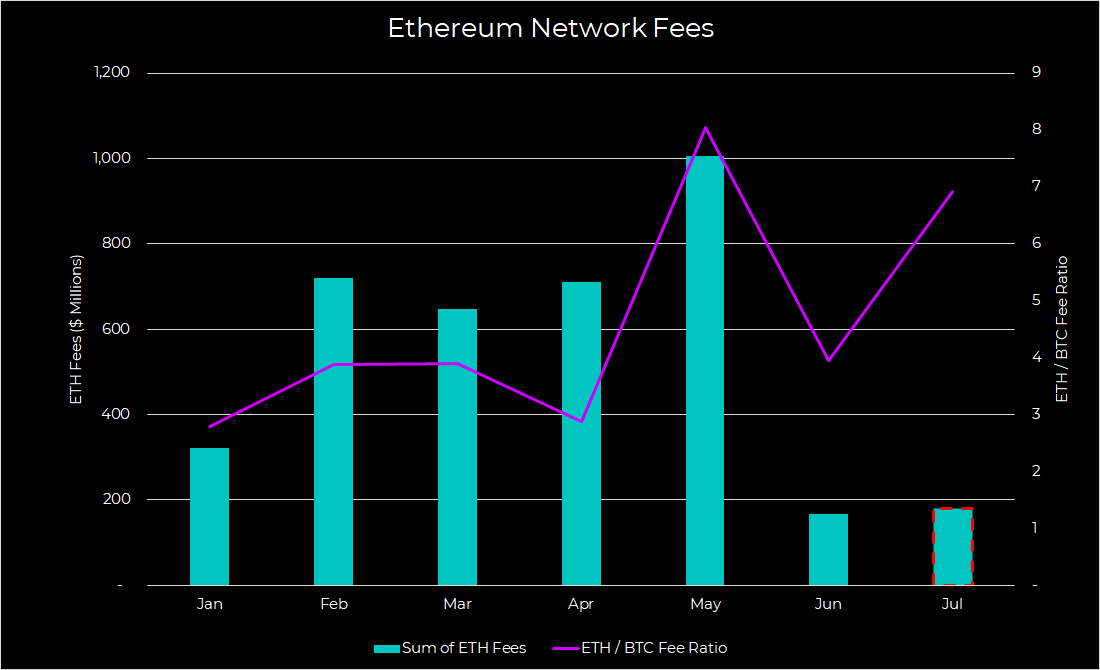

- ETH fees rebounded 8% MoM to $180m for July. With EIP-1559 around the corner, the amount of ETH burned will be driven by demand for blockspace. Ethereum has 7x the fees of Bitcoin this month per the quickly recovering ETH/BTC fee ratio. For context, BTC fees declined from $42m to $26m MoM for July. Healthy fee markets result in a stronger security budget for Ethereum. A few notable gas guzzlers in the past 24 hours are UNI V2/V3 (19.5% share), Axie Infinity bridge (7%), and Opensea (2.8%). (Sources: Glassnode, Etherscan)

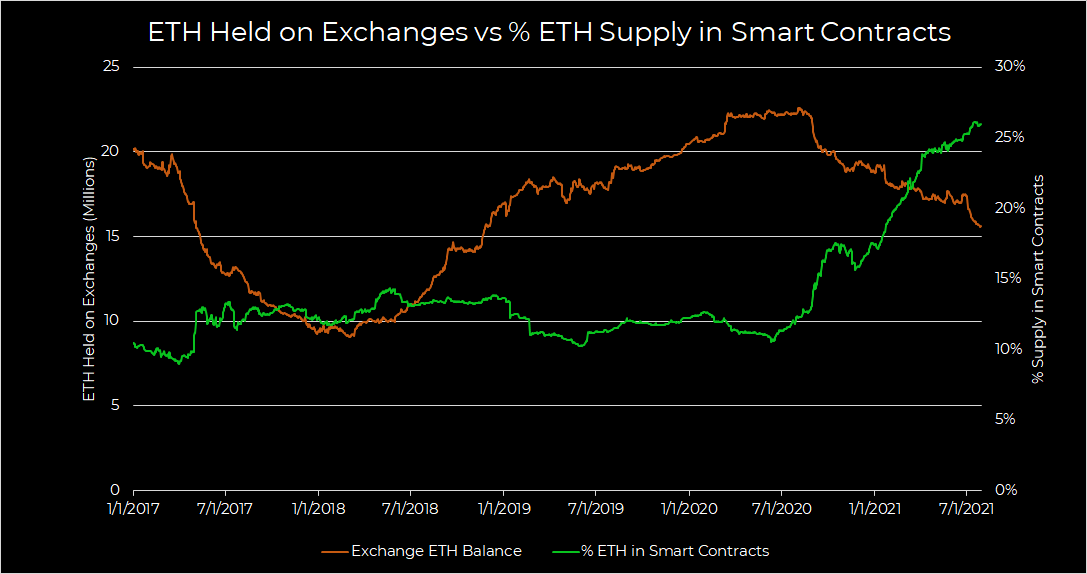

- 26% of the ETH supply is now in smart contracts, marking a 49% YTD increase. Exchange outflows remain strong now up to 17% move YTD. With 6.4m ETH being staked and 9.7m ETH in DeFi, ETH usage has held up strong. ETH users are pursuing more yield opportunities vs simply holding ETH idly on CEXs. (Source: Glassnode)

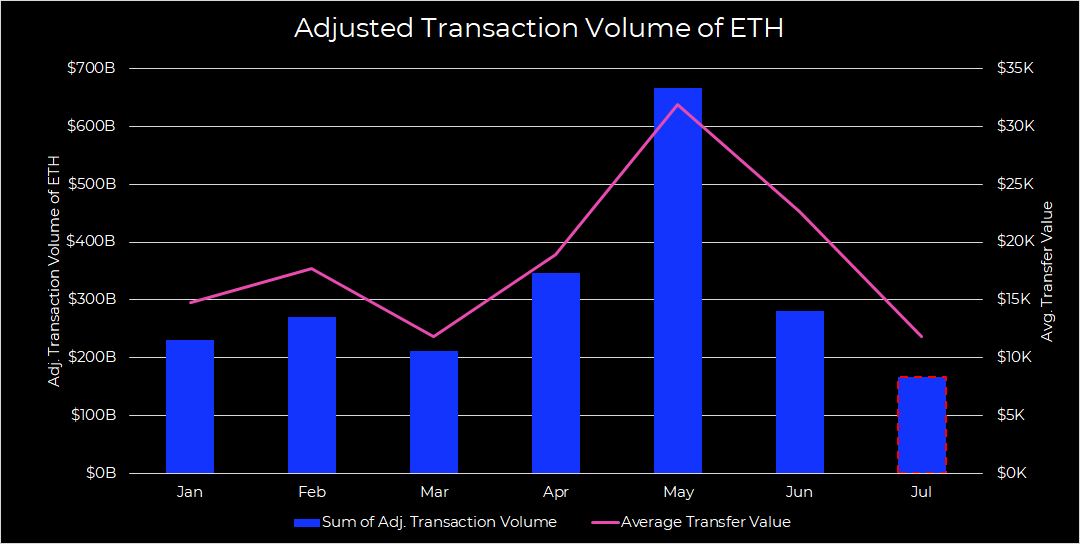

- Ethereum has settled $2.5 trillion in ETH transactions YTD. Although there’s been a big drawdown since May, the current monthly settled volume of ETH for July stands at $167B. Average transfer value of ETH has been reflexive on the way up and down in this cycle, with July numbers dropping to $11.8k. (Sources: Messari, Coinmetrics)

④ Terra

👥 Brendan Murray

📈 80K+ New Users Flock To Terra In Recent Weeks

👉 Join the Terra community Discord

🔎 Check out the Dashboard

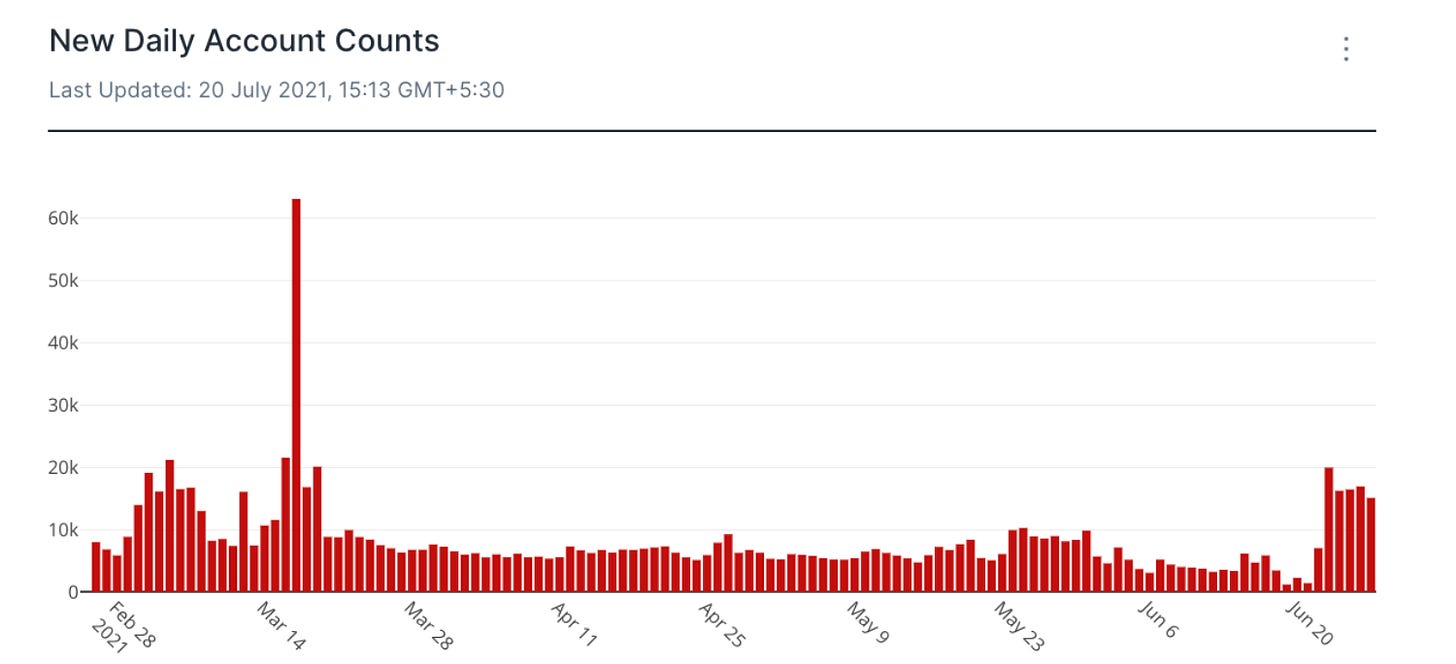

- Terra has seen a flood of new users in recent weeks. More than 10,000 new accounts were registered on each of the last few days of June, a significant increase over the 5,000 to 8,000 accounts that typically join each day. This is also the highest level of new account growth since the mid-March record-breaking peak caused by the launch of Anchor. Many of these new users quickly began investing in and using core Terra projects, including savings protocol Anchor and synthetic assets platform Mirror. (Source: Flipside Crypto)

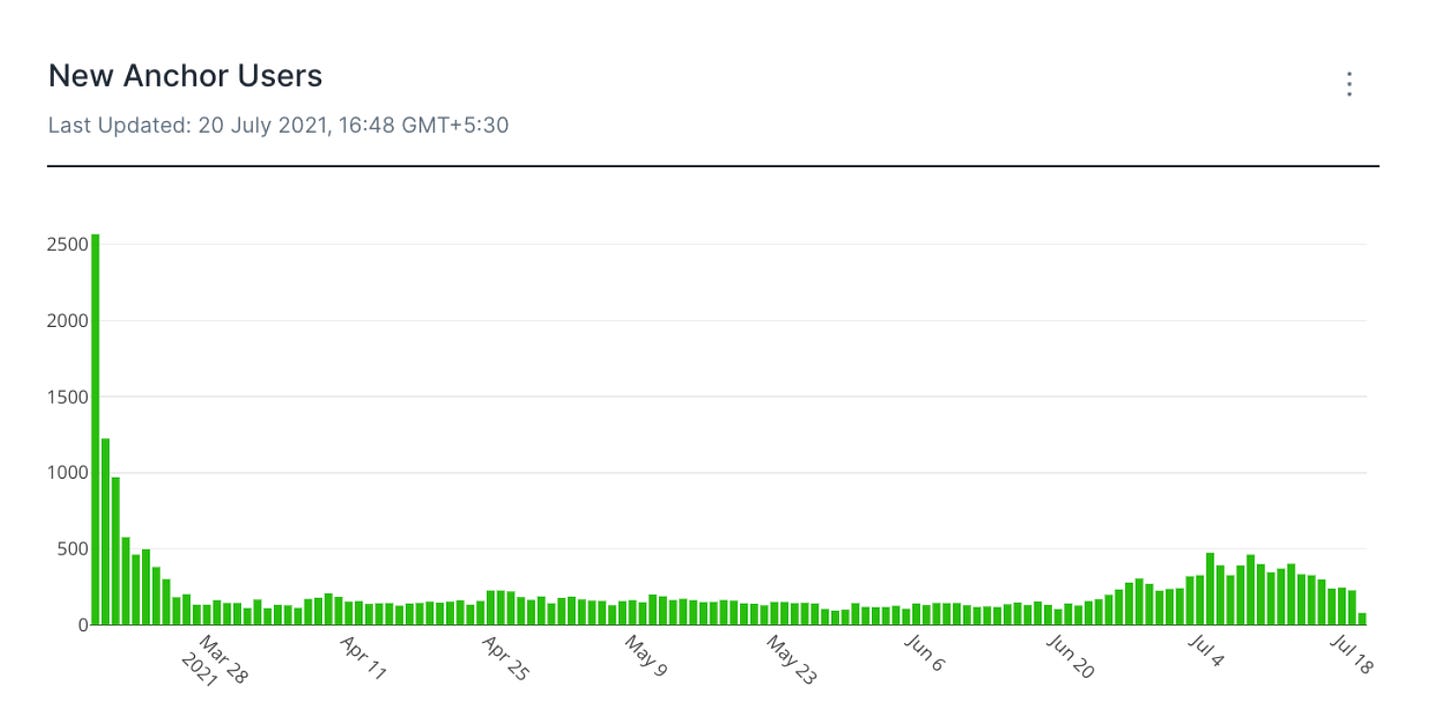

- On Anchor, recent activity has seen the highest number of new accounts registering since the platform debuted in March, peaking at nearly 500 new users per day earlier this month. This has likely been driven by volatility in crypto markets and increased interest on loans from the Anchor Money Market. (Source: Flipside Crypto)

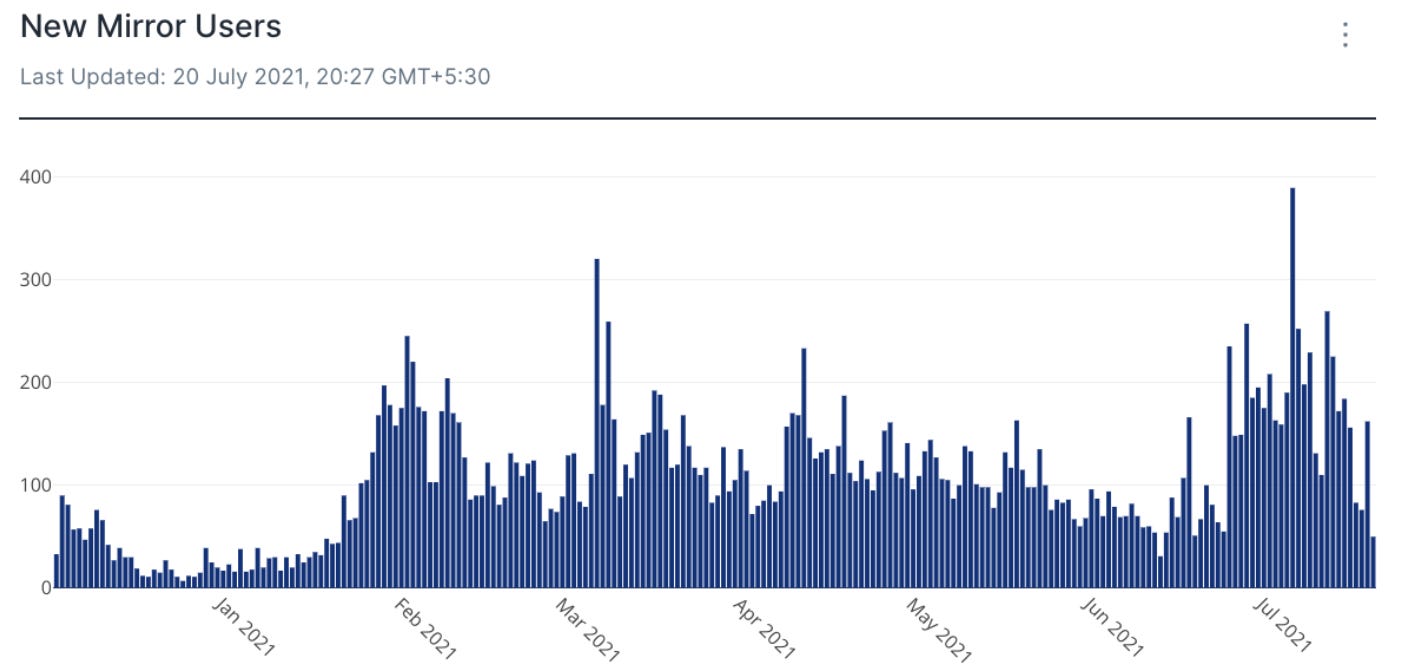

- Mirror began to see large spikes in new accounts created in Q1 as new users rushed into the crypto space. Registration numbers returned to lower levels following these initial peaks in mid-March, but the number of new accounts has risen quickly following the recent launch of Mirror v2 on June 24. (Source: Flipside Crypto)

About the editor: Spencer Noon is General Partner at Variant, a first-check crypto VC fund.