Our Network: Issue #87

September 3rd, 2021

- 🤝 All funds raised via NFT sales go directly back to our contributors each week. Thank you for supporting community-driven crypto analytics!

- 🕛 About the editor: Spencer Noon is an investor at Variant, an early-stage crypto VC fund. Founders should DM him to get in touch.

- ⭐ Click here to apply to the 🆕 Our Network Talent Agency

- 📥 Subscribe to the newsletter and get Our Network delivered straight to your inbox every week.

① Filecoin

👥 ZX

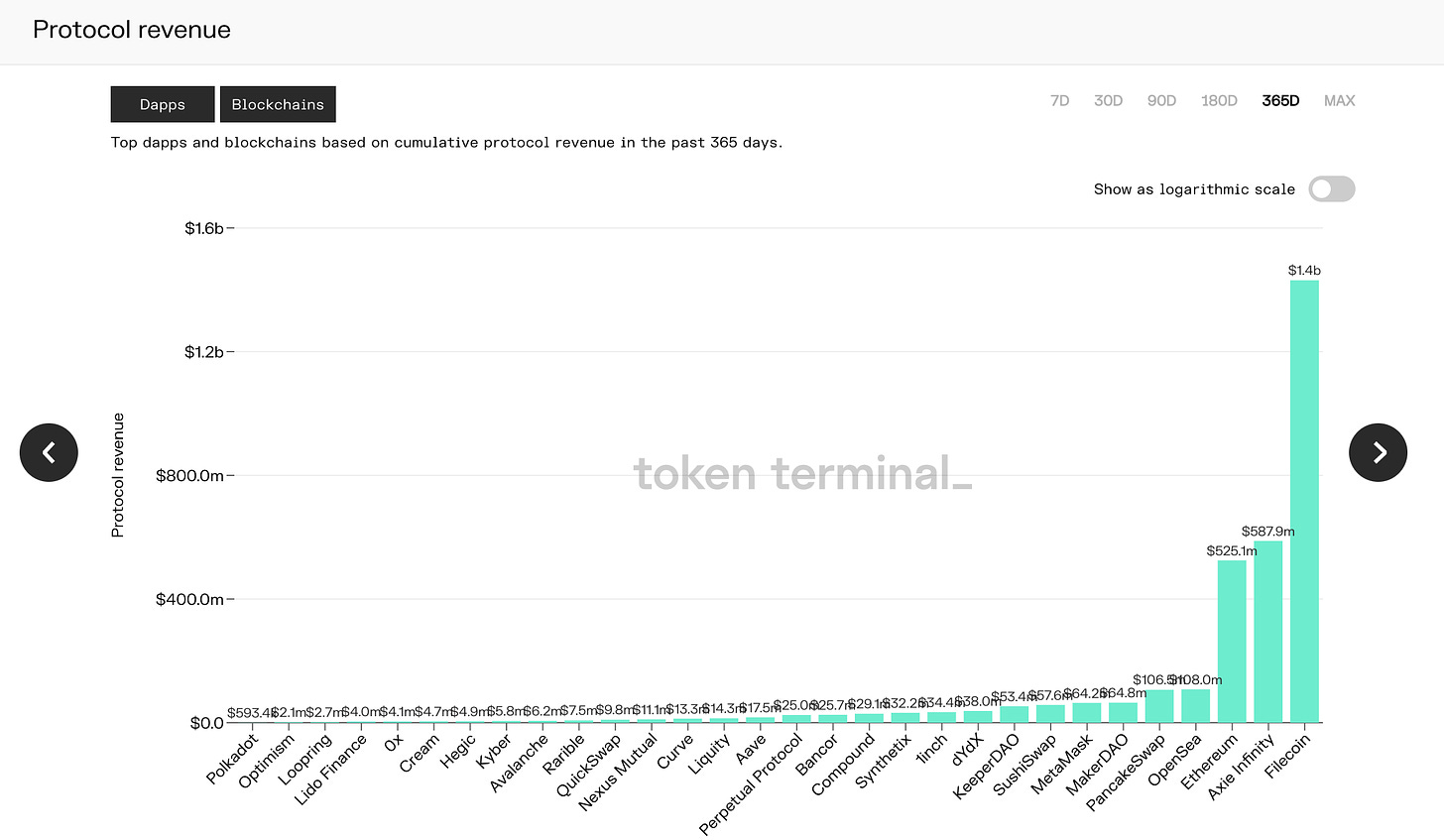

📈 Filecoin Surpasses $1.4B in Protocol Revenue

- Filecoin is a decentralized layer-1 protocol that allows anyone to provide verifiable storage and adjacent services. One can think of Filecoin as an Airbnb for cloud storage. Since its launch, Filecoin has reached 10EiB in capacity, more than 3000 storage providers & 10,000 developers building applications on Filecoin. The active usage of the protocol has generated more than $1.4B in protocol revenue. Filecoin is also the largest zk-SNARK network and recently had a 10-25x scalability improvement.

- More than 106M FIL ($8.5B) are locked as collateral. In the context of Filecoin, collateral ensures both consensus security and storage reliability. More than 50PiB of storage is added every day with an additional 300,000 FIL locked.

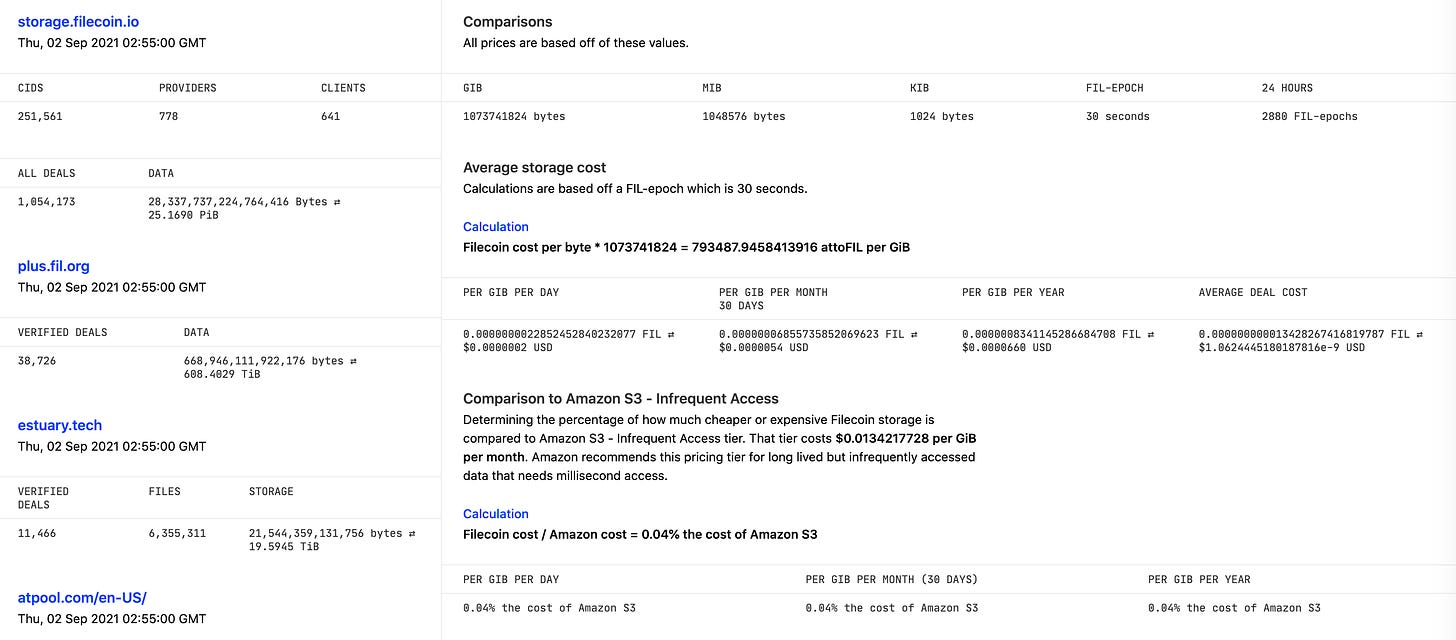

- While Filecoin is not just about cost, Filecoin storage providers are offering competitive prices. It’s estimated at 0.04% of Amazon S3 and many are offering FREE storage for Filecoin Plus deals. Currently, there are 25PiB of deals on Filecoin. Many providers are building new and differentiated experiences.

② The Graph

👥 Eva Beylin & Ricky Esclapon

📈 Subgraph Migration grew 195% since Studio Launch

👉 Community Discord 📌 Job Board 🔎 Dashboard

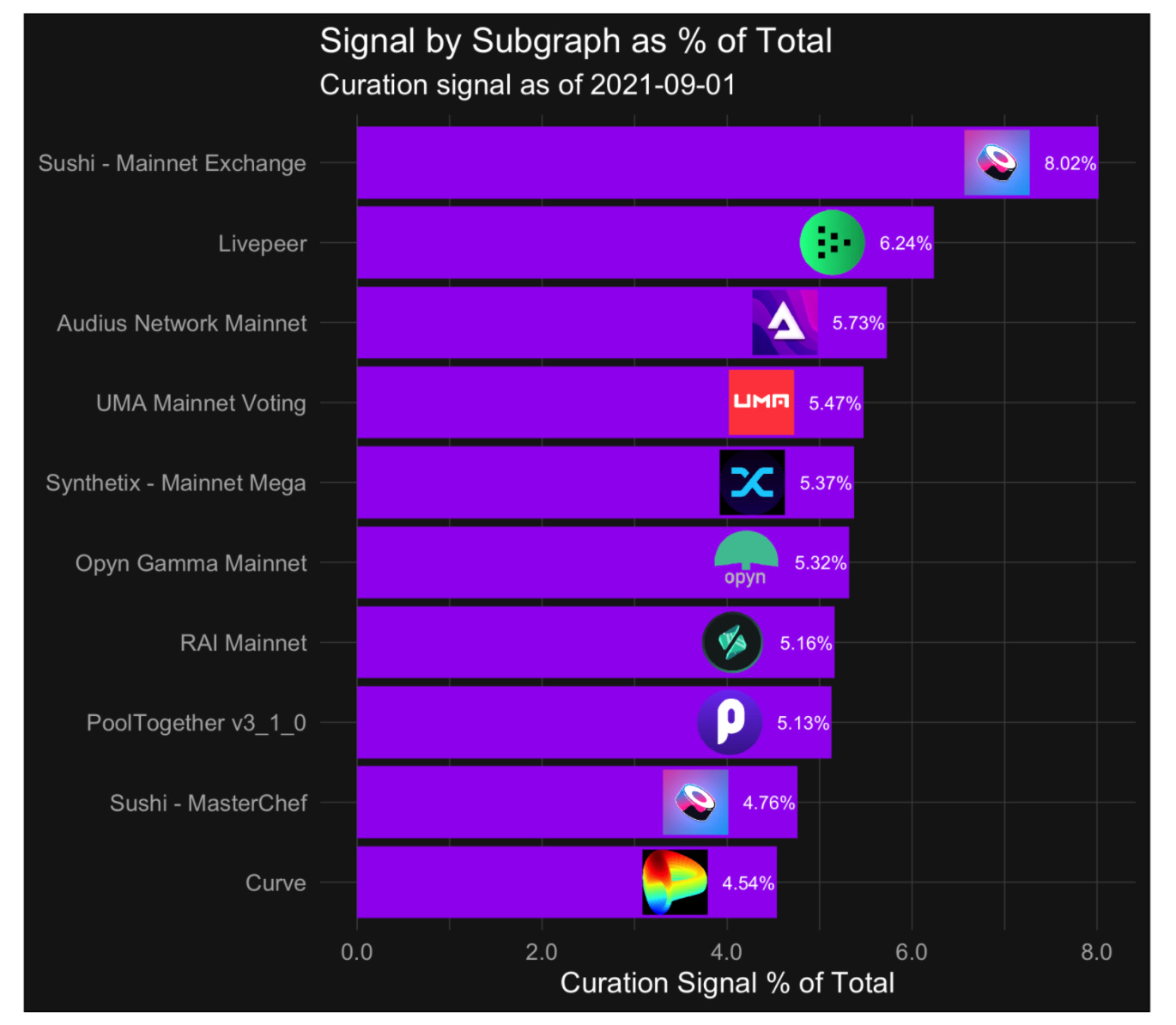

- Curators signal on subgraphs they deem high-quality, so Indexers prioritize the best APIs. The Sushi Exchange subgraph has ~8% of curation signal, followed by Livepeer, Audius, and UMA with ~6% of total signal each. Synthetix, Opyn, Reflexer, PoolTogether, and Curve are also highly signaled subgraphs.

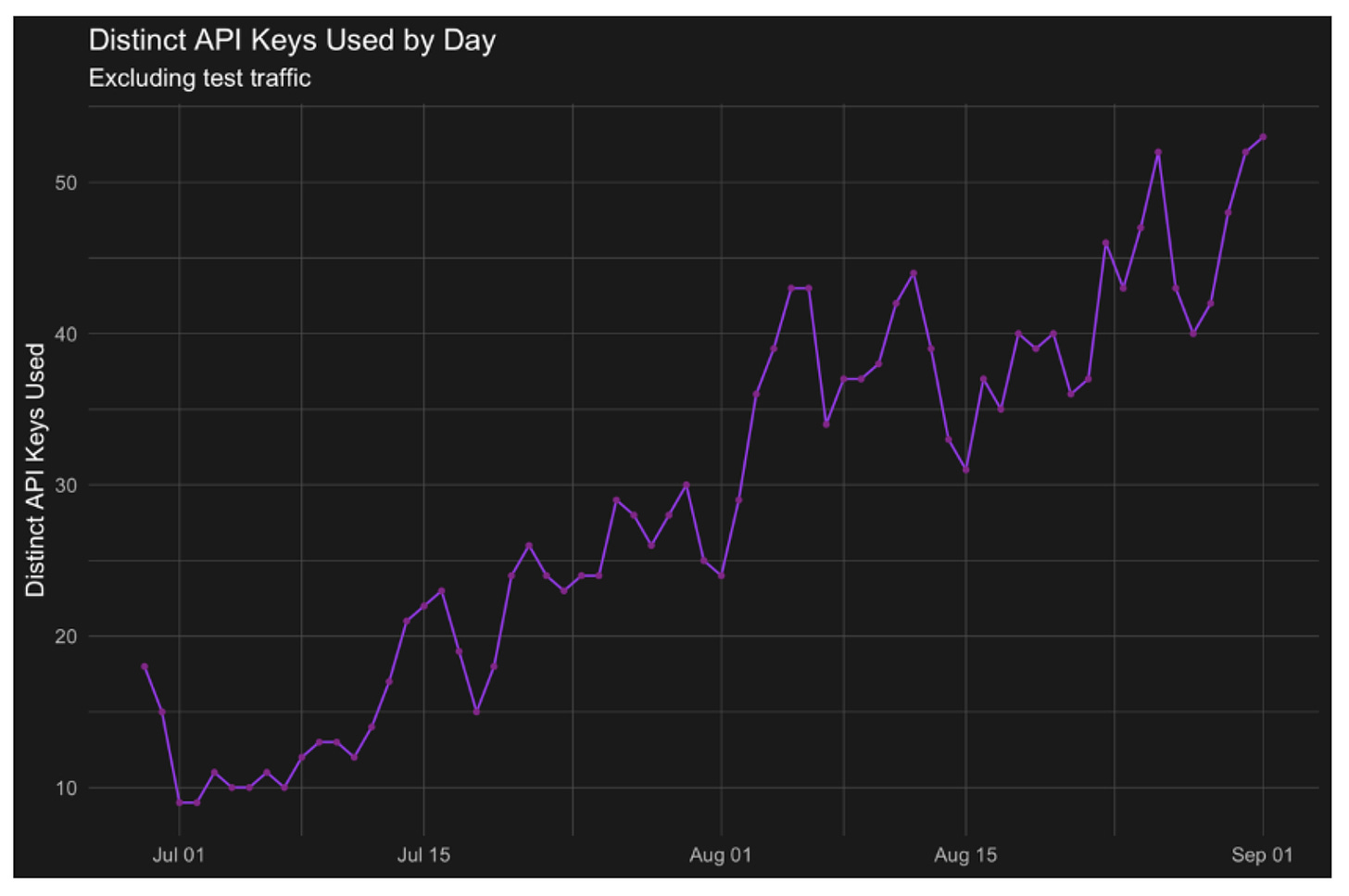

- Developers create API keys to query subgraphs and pay for the usage. API key creation has grown ~195% over the last 2 months as Dapps have been migrating their subgraphs from the hosted service to The Graph Network to ensure Dapps are decentralized. 50+ unique API keys are used daily in Web3 today!

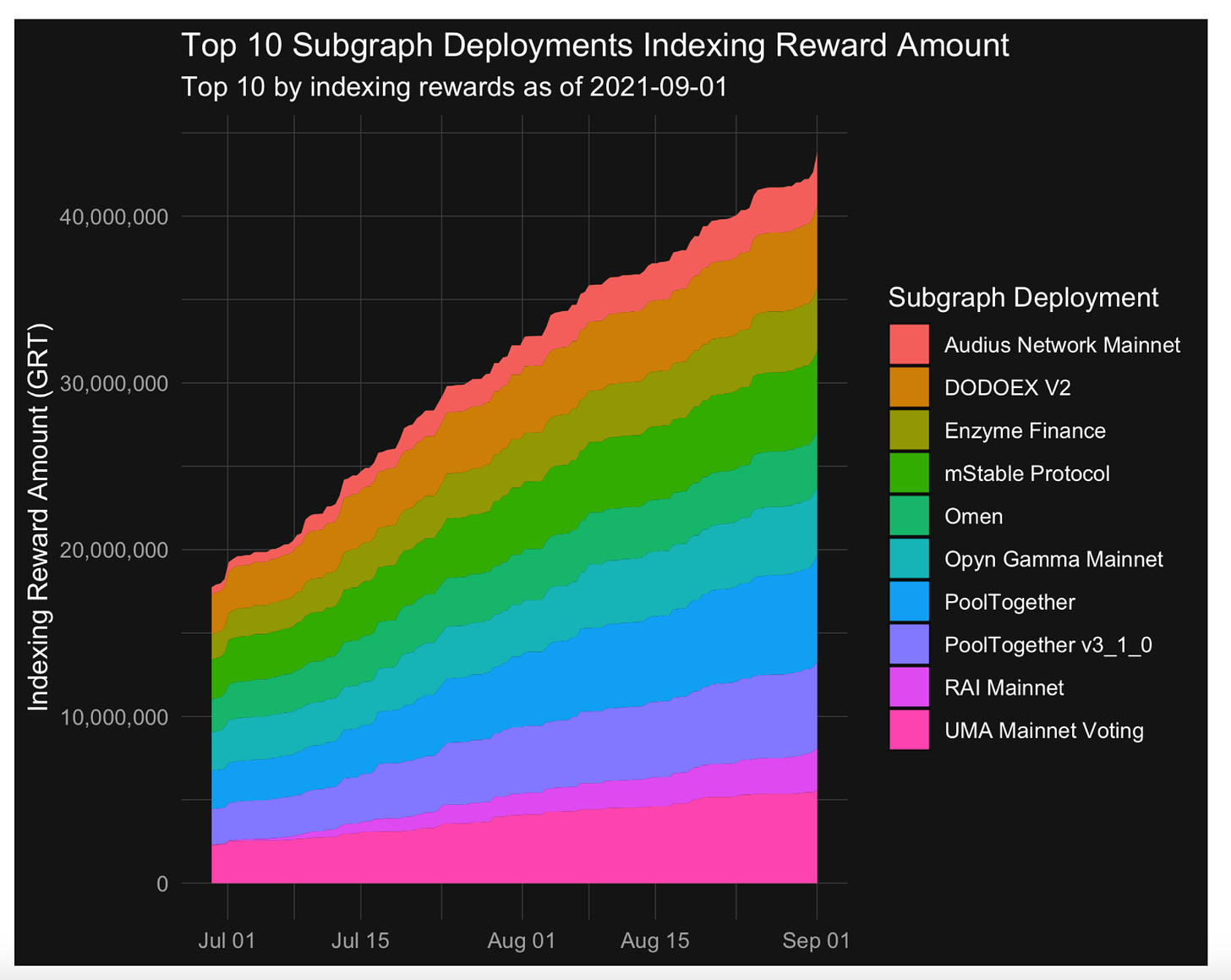

- Indexers are allocating to the subgraphs they want to serve to earn indexing rewards. Over 43M GRT in rewards has been earned for processing queries for the top 10 subgraphs, growing ~147% since late June. The UMA voting subgraph leads with the most rewards followed by PoolTogether, mStable, and DODO.

③ Gitcoin

👥 Omni Analytics Group

📈 Gitcoin has generated $29.9M in funding for OSS!

👉 Community Discord 📌 Job Board 🔎 Dashboard

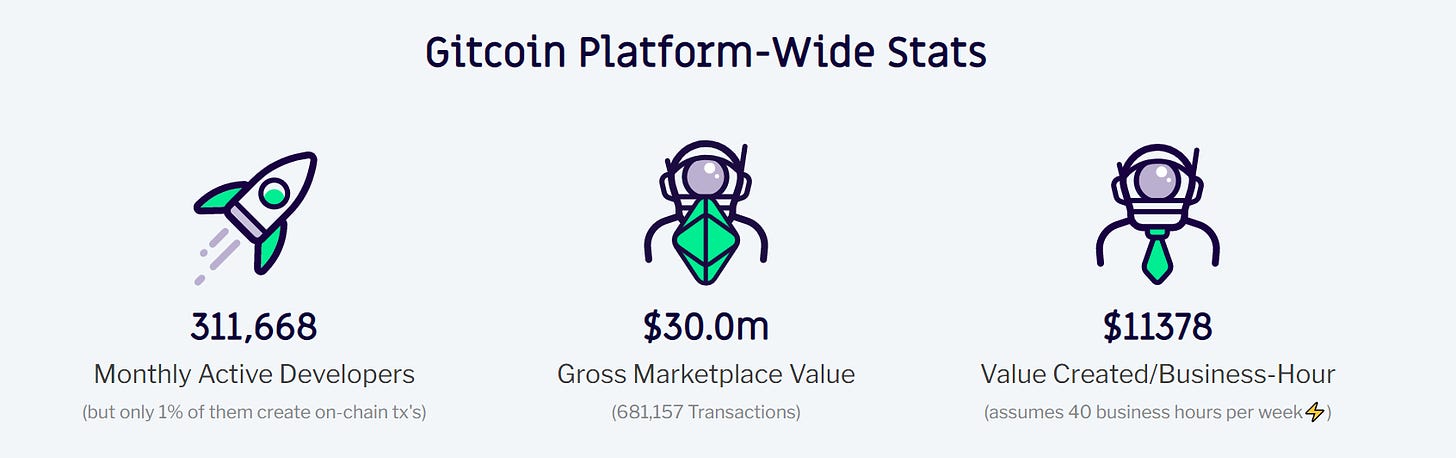

- Come September 8th, Gitcoin will be kicking off Round 11 with an estimated matching pool of $900,000 to be quadratically dispersed across nearly 2,000 grants on the platform. Funding for this round will represent a $200,000 increase over the amount available for open-sourced projects in the previous quarter. Since our last coverage, the number of monthly active developers has nearly doubled to 311,688 and total open source funding across the platform has jumped over $9M from $20.7M to $29.98M.

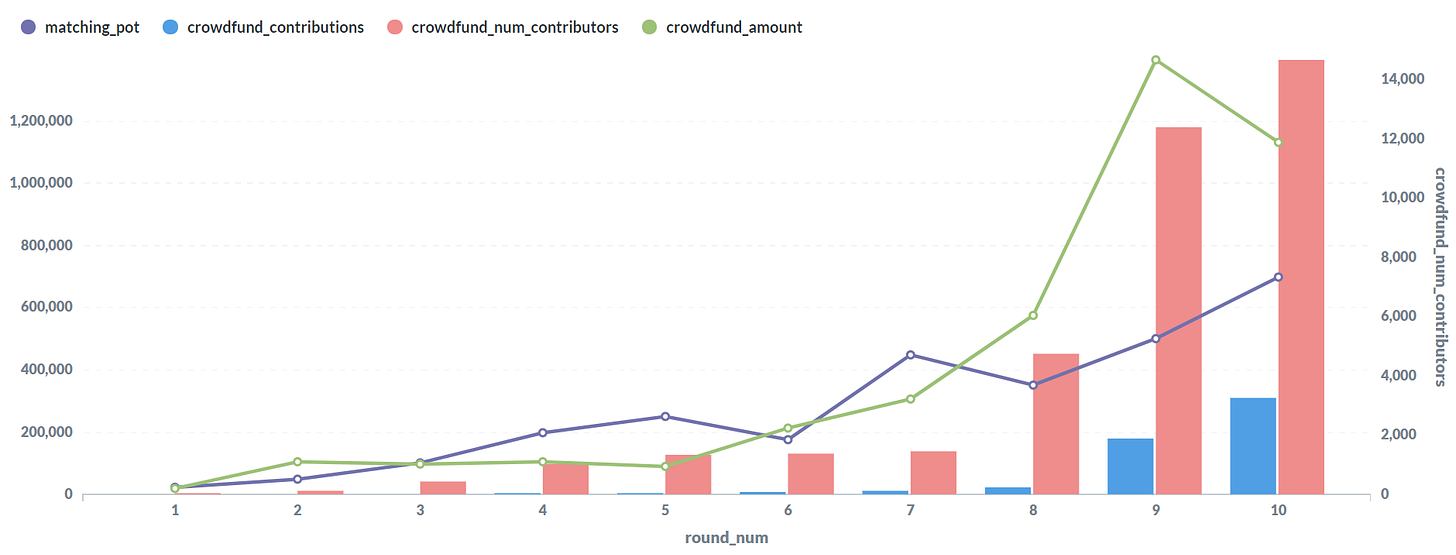

- Over the last 10 rounds, not only has Gitcoin seen increases across the size of the matching pool, but also in the number of contributors, contributions, and the overall amount contributed. In the most recent round, 14,658 contributors made 308,658 contributions that amounted to over $1.1M in project funding.

- Through their use of a quadratic funding, Gitcoin encourages smaller donations and is the main reason why the median contribution is only $1.21. While this individual amount is small, successful grants with more than 5K contributors have the opportunity to receive over $40K in matching funds.

④ Pocket Network

👥 Lewis Harland

📈 Pocket Network Surpasses 40m Daily API Requests

👉 Community Discord 📌 Job Board 🔎 Dashboard

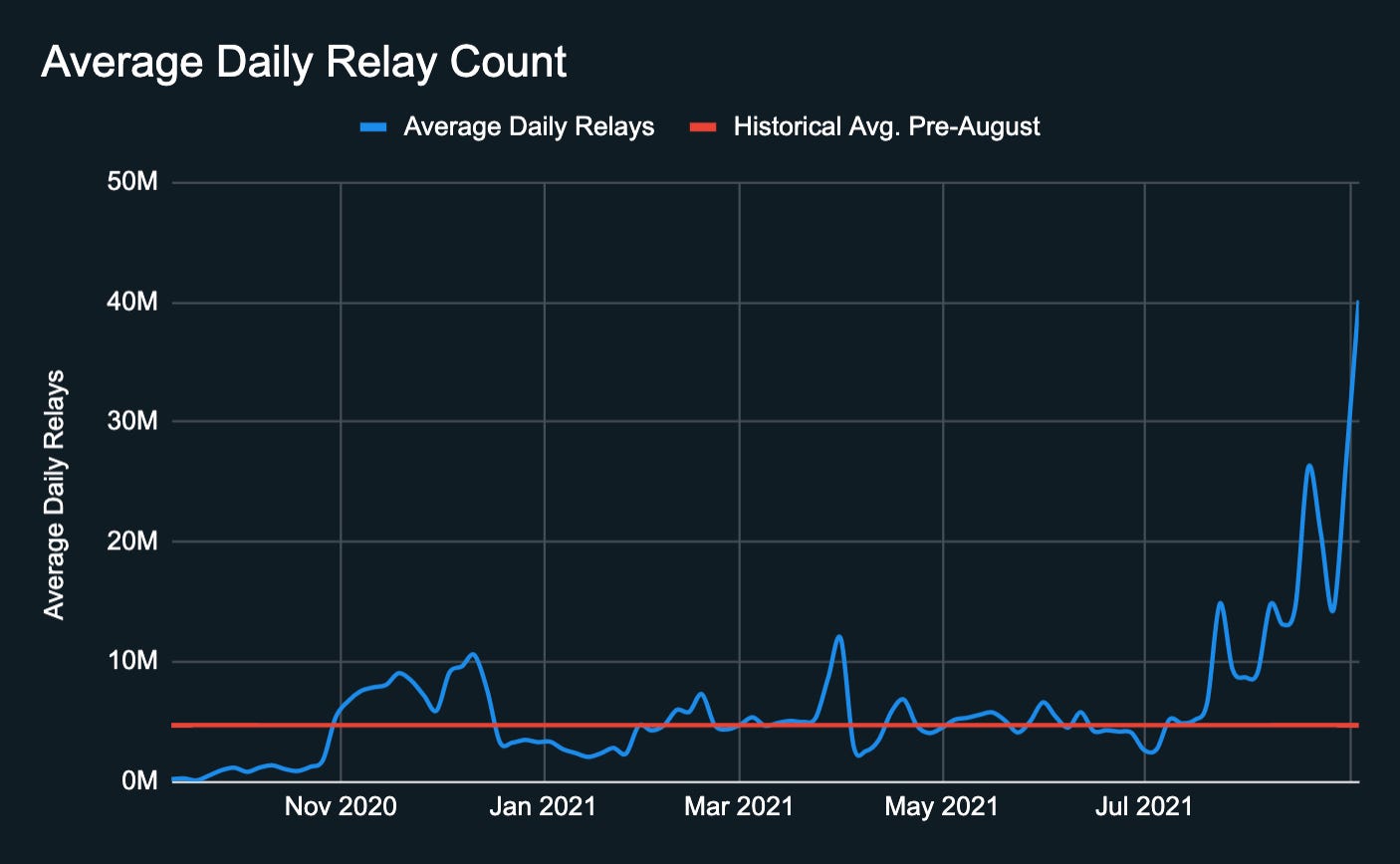

- Pocket Network has seen strong growth in the average number of daily relays. The network saw a historical average of ~4.5M requests a day pre-August. Now the network is printing an all-time-high of ~41M average daily relays. Key drivers for relays have been demand from Dark Forest players and Austin Griffith's scaffold.eth tooling for solidity developers.

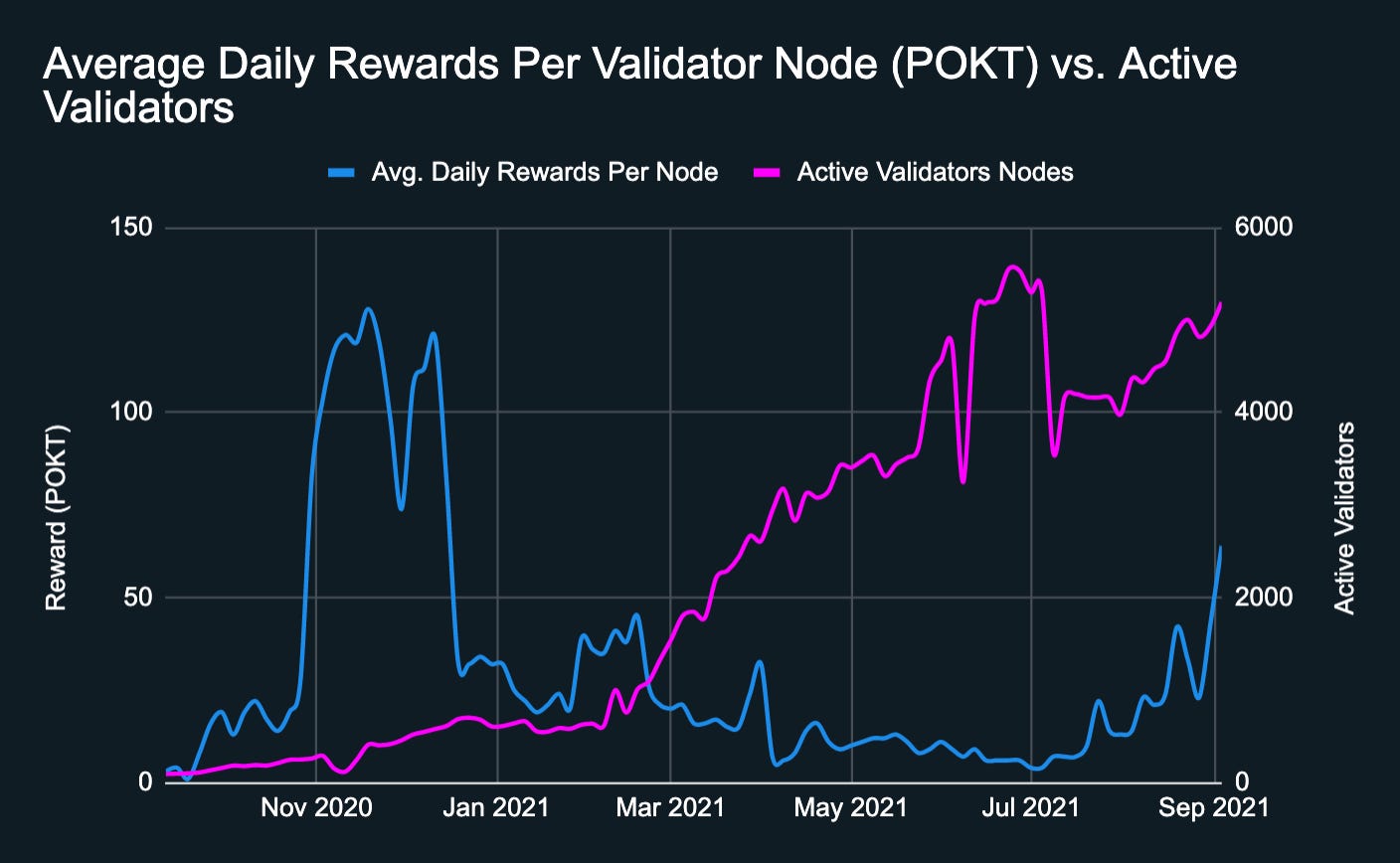

- Pocket Network is equally seeing healthy growth in active validator nodes who serve Pocket’s integrated applications. The drop in late June was likely driven by a reduction in relays (and therefore node rewards) and demonstrates that capacity changes dynamically according to network demand.

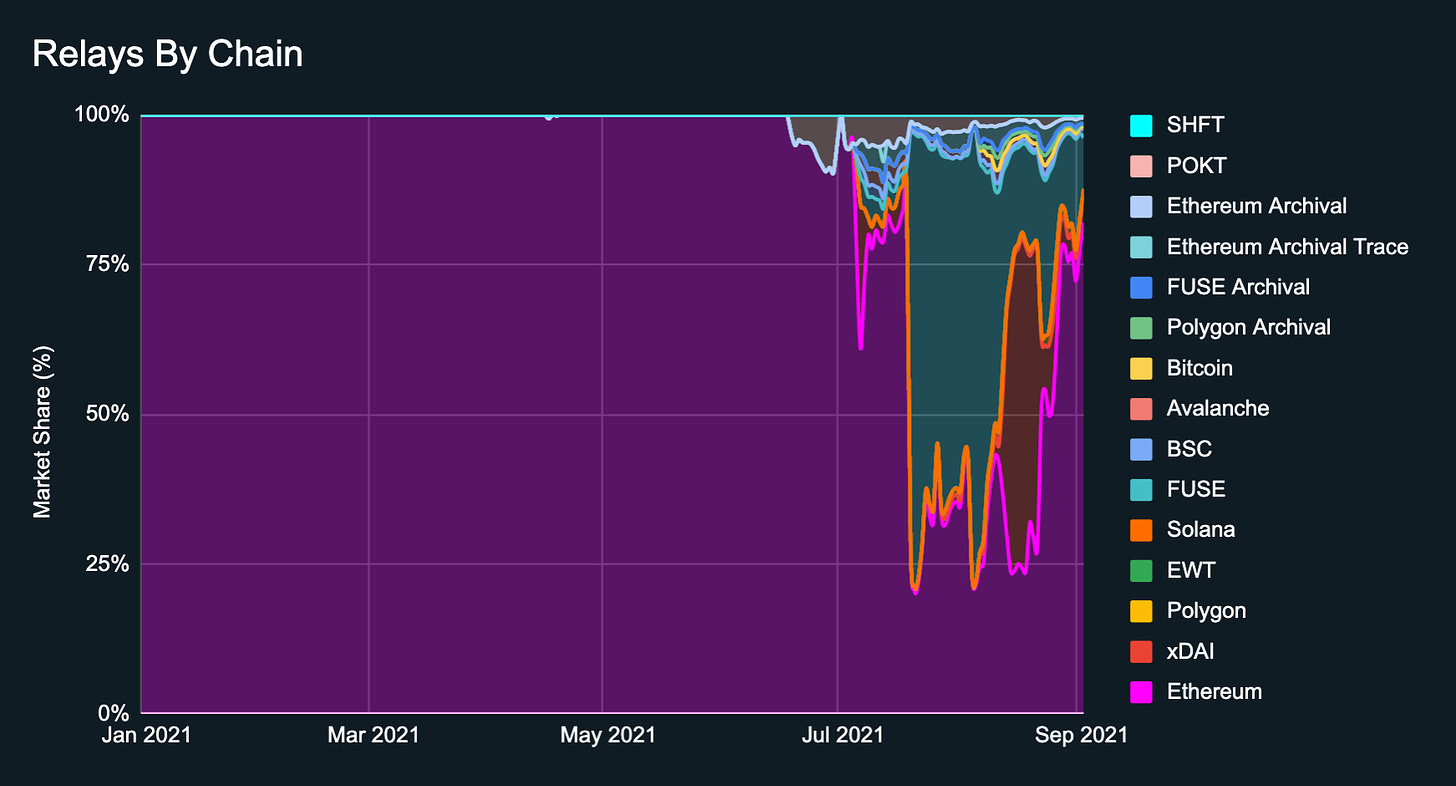

- Pocket’s recent integrations of other chains has lead to an increasing diversification in which traction is being sourced including Fuse and xDAI. Ethereum mainnet remains the dominant source of relays today (80% market share) but it is reasonable to see the chain’s dominance decline over time.

Subscribe to OurNetwork

Receive the latest updates directly to your inbox.

Verification

This entry has been permanently stored onchain and signed by its creator.

Arweave Transaction

GtD4ZKc5lS0aVy-…zhcazD2sNS_3kg4

Author Address

0x9C159121CEEBF93…0c895d7f6038bd4

Content Digest

qvLMsCzXmRBx1Yn…-U8nfeMAnTeydjU